Alignable, the small business referral network, has released its May State of Small Business Report. It’s primarily based on a poll of 7,751 small business owners conducted from 4-24-21 to 5-9-21, but also features insights gathered over the past year from 625,000 SMBs.

Key findings include:

- COVID-19 is still greatly impacting 38% of small businesses, but 24% say the effects are declining.

- Early optimism is evident in a hiring spree led by restaurants and retailers expecting a major summer sales surge. In fact, hiring has reached a new high, as 88% of pre-COVID employees are back on the payroll.

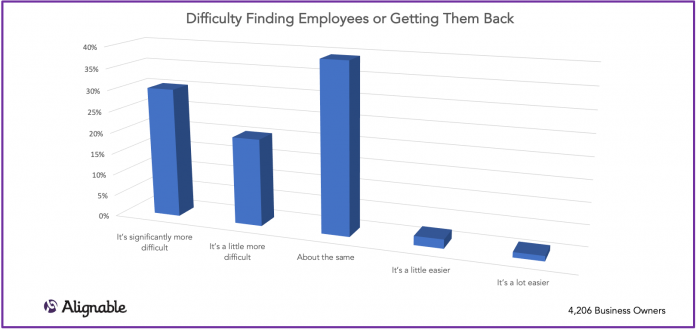

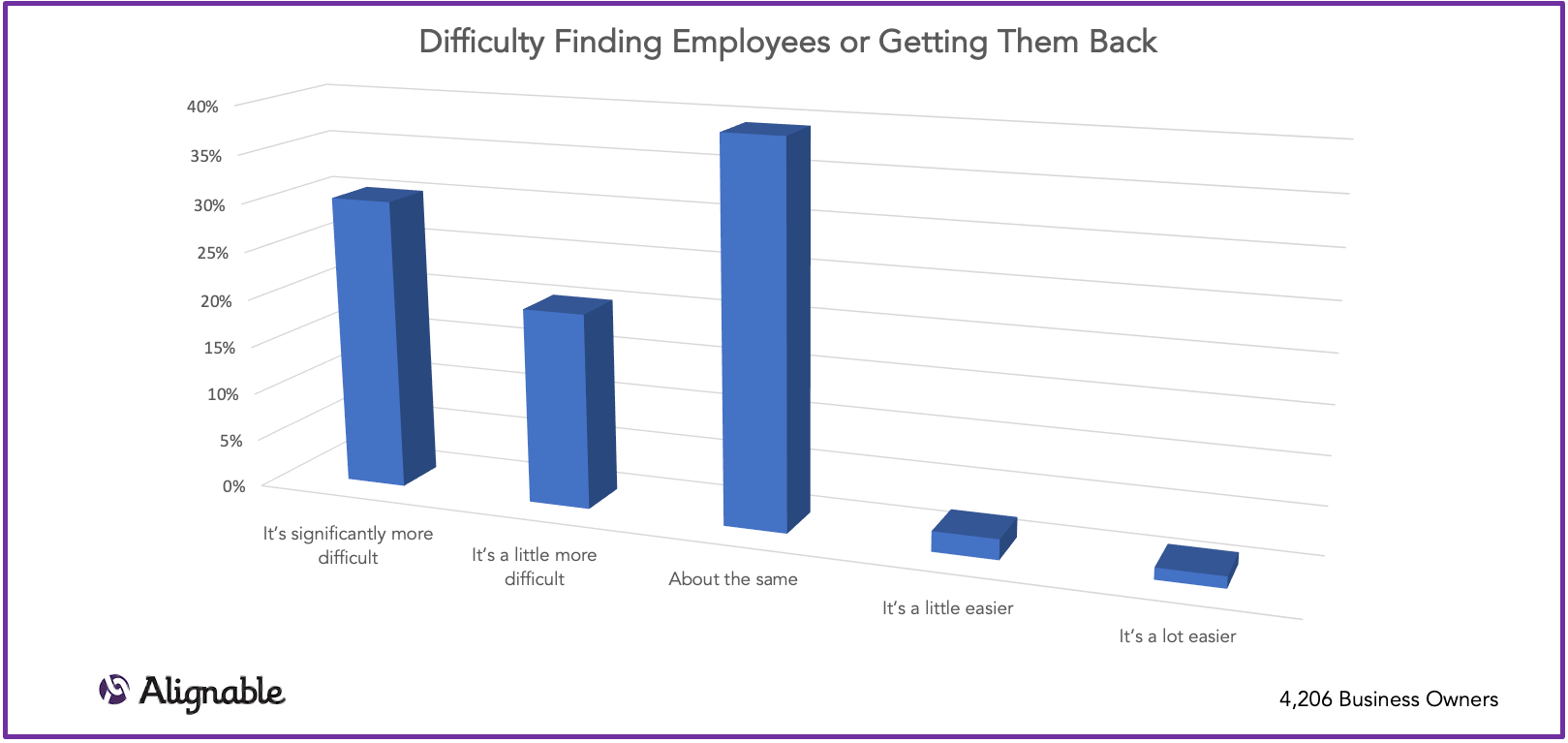

- While that’s promising, the overall employment picture is much more volatile—50% of small business employers can’t fill vacancies.

- The majority (54%) say it’s because government handouts are preventing workers from applying (30% believe the controversial $300 weekly supplemental unemployment benefit is keeping people home, while 24% blame stimulus checks).

-

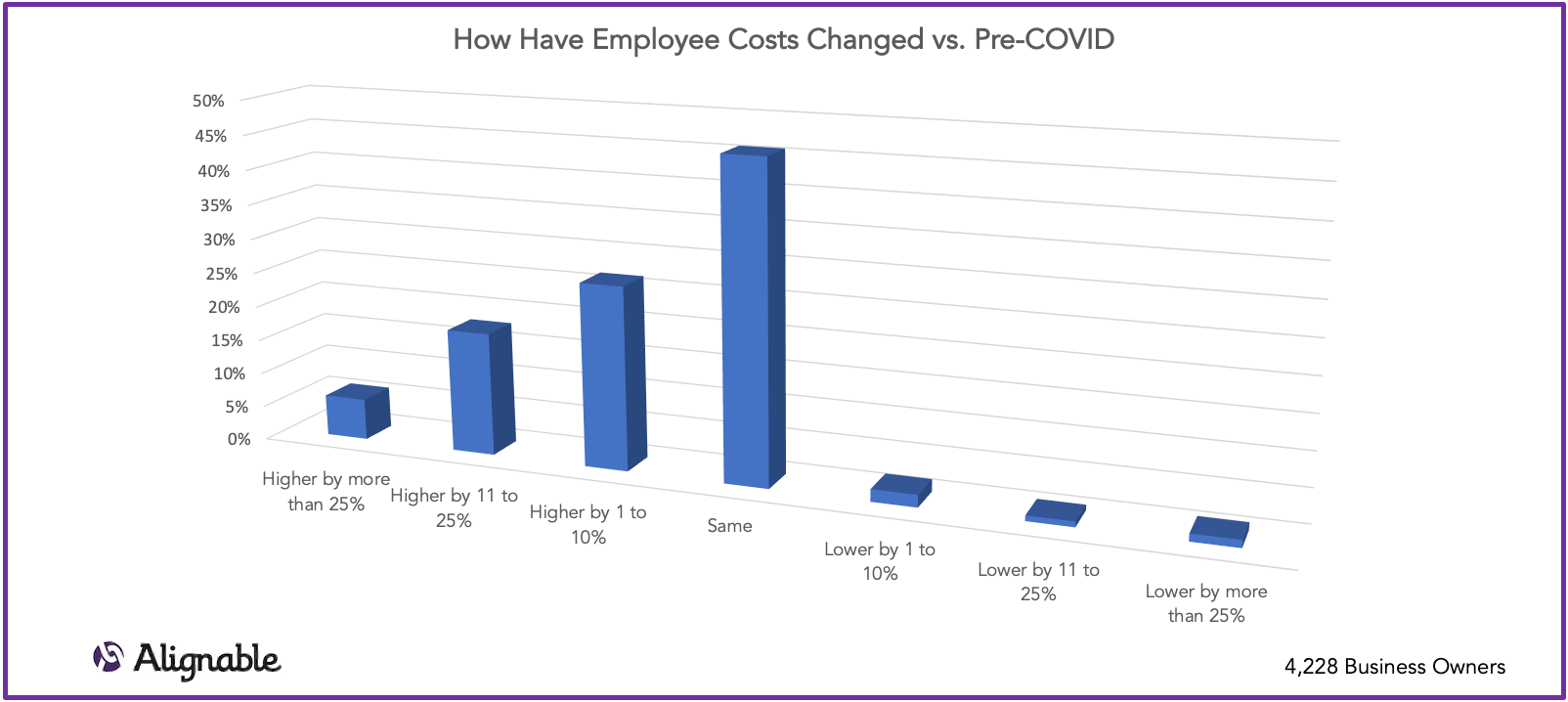

- However, when employers do find people to hire, 51% say they have to pay higher wages than they paid prior to COVID.

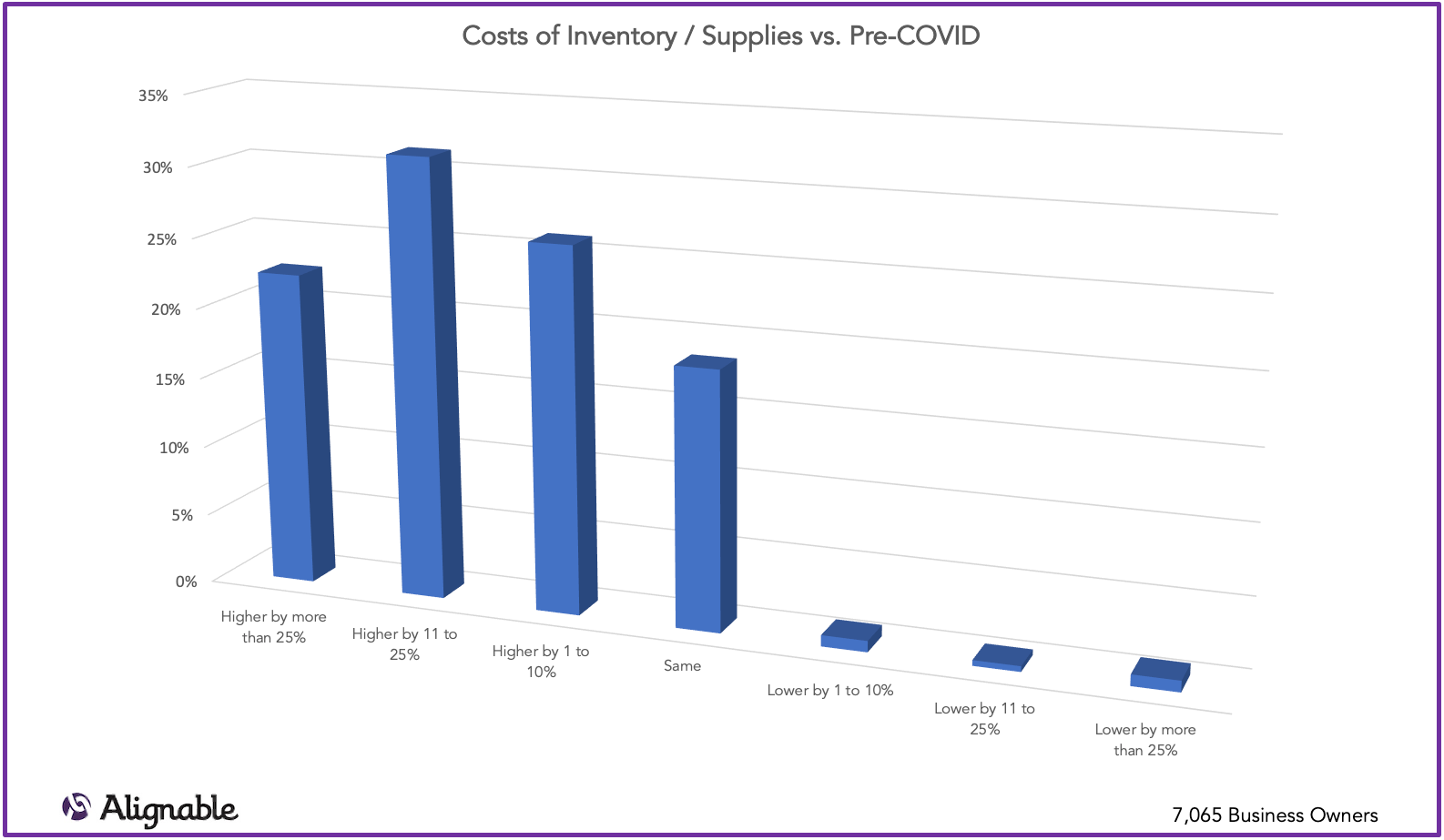

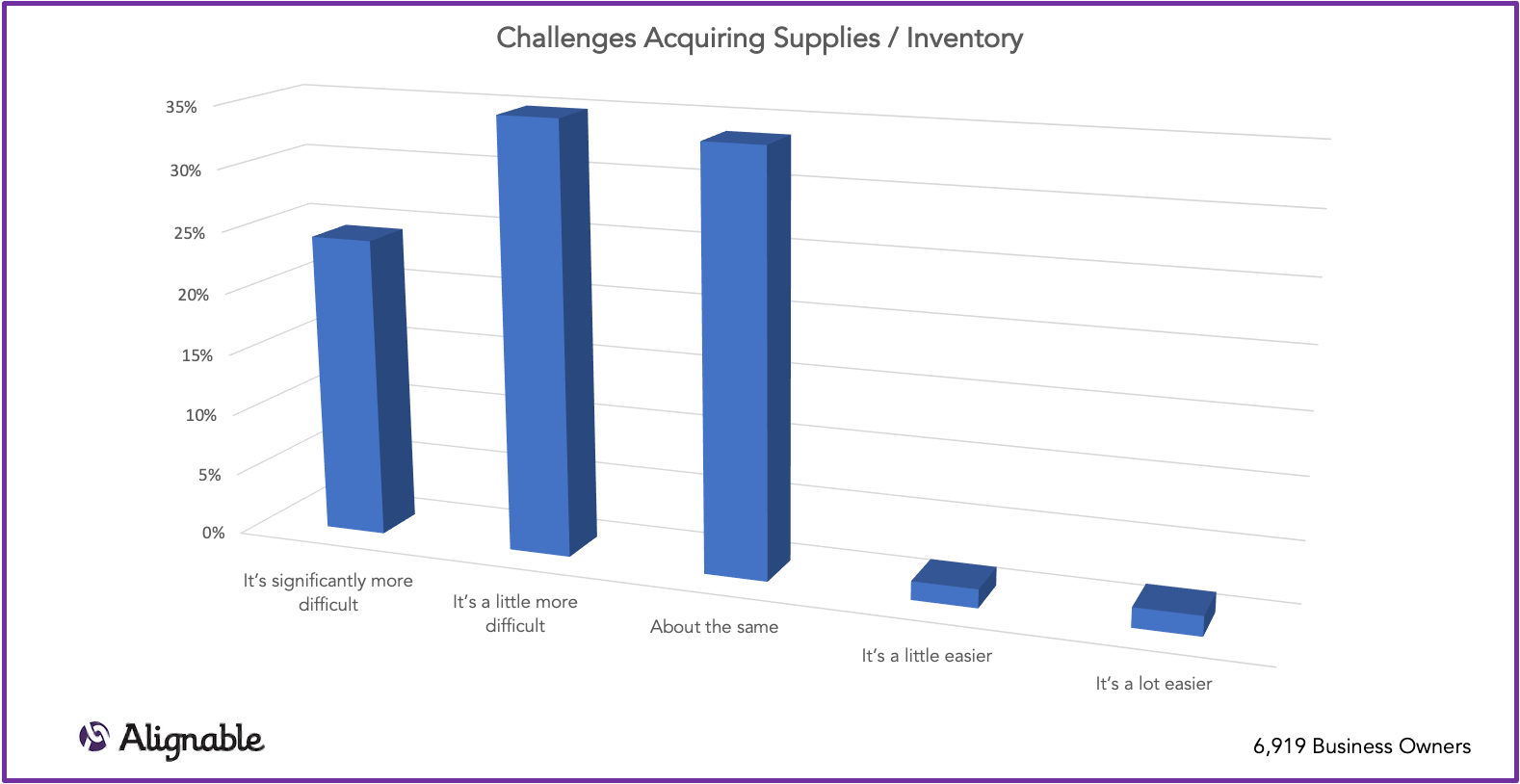

- And while some small businesses are starting to bounce back, they’re confronted by other inflationary trends. In fact, 67% of all SMBs fear that inflation will hurt their recovery. And those figures are even more dramatic among industries facing major supply delays, shortages, and skyrocketing prices (especially for wood and metal).

On top of everything else, revenues are lackluster and declining. Sadly, 58% of small business owners are only earning half or less of their monthly pre-COVID revenues (that figure was just 48% last month).

On top of everything else, revenues are lackluster and declining. Sadly, 58% of small business owners are only earning half or less of their monthly pre-COVID revenues (that figure was just 48% last month).

- And 34% have only one month or less left of cash reserves (that’s up 4% from April).

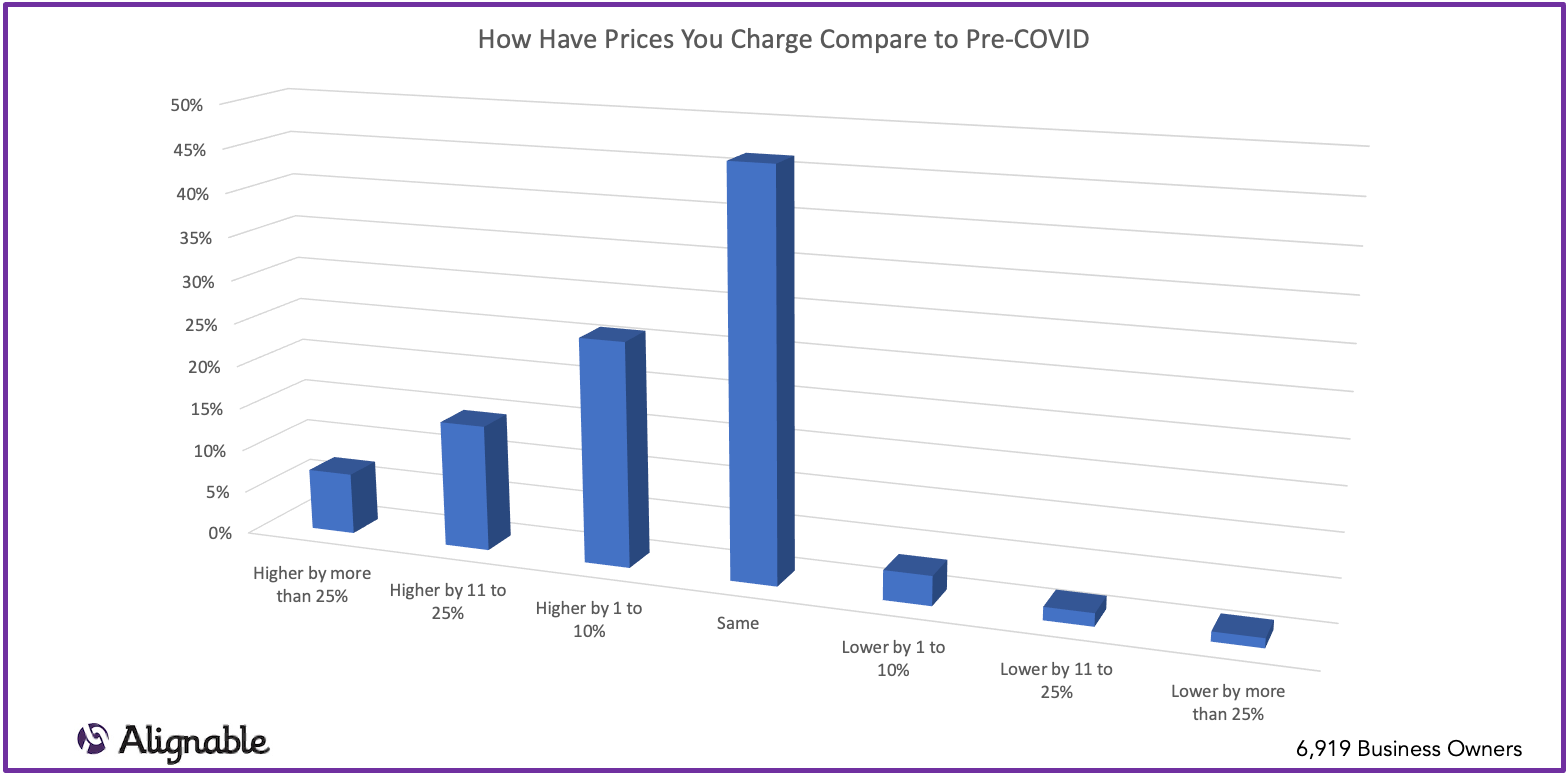

- Despite all of these changes, 52% say they have kept prices they charge flat or lower.