Sign Builder Illustrated recently invited readers with purchasing power to take part in an online survey detailing their plans for equipment purchases and more for 2024. More than 200 professionals responded. We hope these results help you gauge how you compare.

Let’s start with general demographics: Respondents described their sign companies as Full-Service (73.7%), Print Provider (6.6%), and Electric/Dimensional (4.6%), while 15% identified as Other (Installation, Architecture, Design, etc.).

The number of employees, including themselves, broke down as: One-person (9.3%), 2-5 (37.1%), 6-10 (27.2%), and More than 11 (26.5%).

Estimated total revenues generated by respondents’ sign companies over the past twelve months were: $1,000,000 or More (42.3%), $500,000 to $999,999 (22.9%), $100,000 to $499,999 (24.8%), and Less Than $100,000 (10.1%).

Survey participants were allowed the option to be contacted for further details, and you’ll find some of these responses presented throughout our results.

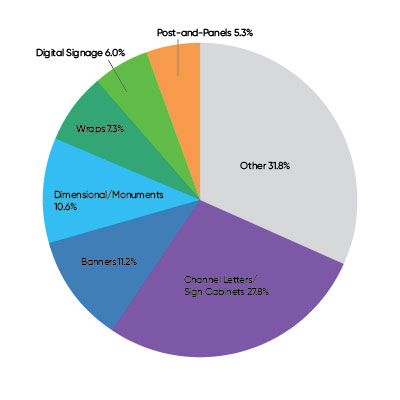

The Most Popular Sign Product respondents offer customers today:

Sign Builder Illustrated would like to thank everyone who took the time out of their schedules to respond to our questions. Now on to the results and analysis!

Sign Builder Illustrated would like to thank everyone who took the time out of their schedules to respond to our questions. Now on to the results and analysis!

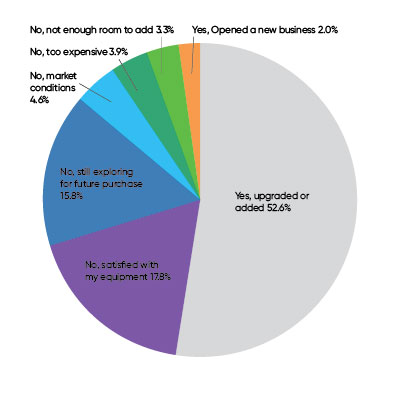

Q1: Did you purchase any equipment/hardware over the past twelve months?

More than half of our respondents either upgraded from their existing hardware or added new technology, which is an encouraging sign from this sample size. Of those that did upgrade or add, 50% have plans to do so again in 2024. For those that did not purchase any equipment in 2023, only 35% indicated that they planned to make a purchase in 2024.

More than half of our respondents either upgraded from their existing hardware or added new technology, which is an encouraging sign from this sample size. Of those that did upgrade or add, 50% have plans to do so again in 2024. For those that did not purchase any equipment in 2023, only 35% indicated that they planned to make a purchase in 2024.

Q2: What best reflects your shop’s interest in purchasing new equipment/hardware in 2024?

A little more than half of our respondents (52.6%) said they did indeed plan to purchase new equipment in the coming year.

The most popular response here was adding to pre-existing equipment while also bringing onboard different equipment (36.3%).

Following closely behind was the option to bring in new equipment to explore new markets (35.0%).

Meanwhile 29.0% said they planned to add similar equipment to what they were already using.

The following percentages are those planning on making at least new one equipment purchase in 2024 within their annual revenue group: Less Than $100,000 (64.3%); $100,000 to $499,999 (43.2%), $500,000 to 999,999 (44.4%), and $1,000,000 or More (59.3%).

For the remaining 48.4% of respondents who do not have plans to purchase new equipment this year, the overwhelming majority (75.0%) indicated that they are satisfied with their current equipment/hardware. The second most selected option was “Worries About the Economy or Business Prospects” (17.0%) followed by “Cost” (8.3%).

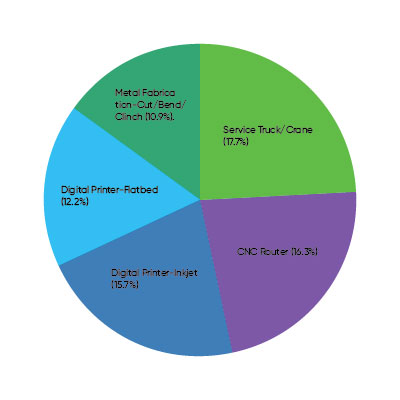

Q3: What type of equipment do you plan on purchasing for your shop in 2024?

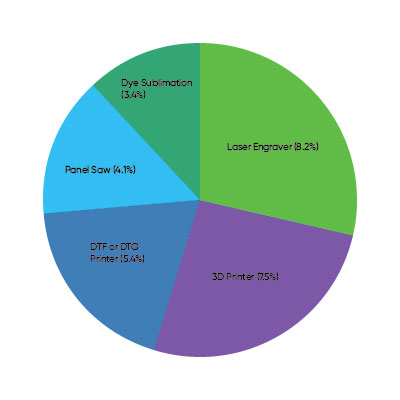

We asked respondents to choose any equipment from a pre-selected list of ten options (in addition to “Other”). “Other” led the way (44.2%), but the top five listed pieces of equipment were:

The bottom five, in descending order:

The bottom five, in descending order:

One-person shops selected, in descending order, CNC Routers (35.7%), Digital Printer-Flatbed (30.8%), and DTF or DTG Printer (25%).

One-person shops selected, in descending order, CNC Routers (35.7%), Digital Printer-Flatbed (30.8%), and DTF or DTG Printer (25%).

Shops with two to five employees chose Digital Printer-Inkjet (32.1%), CNC Router (28.6%), and Digital Printer-Flatbed (25%).

Shops with six to ten employees designated Digital Printer-Inkjet (72.7%), Service Truck (41.0%), and CNC Routers (36.3%) as their top choices.

Shops with Eleven or More Employees chose Service Truck (41.7%) as the top piece of equipment with plans to purchase, beating out Metal Fab-Bend/Cut/Clinch (37.5%) and Digital CNC Router (33.3%).

NOTE: Due to a calculating error involving the number of respondents indicating plans to purchase in 2024, the December 2023 print version of this story featured incorrect choices, which will be addressed in the January 2023 edition. The editorial staff apologizes for this mistake and any confusion it may cause.

Interestingly 30 percent of respondents identifying as “Electric/Lighting” indicated they had interest in purchasing digital printing equipment in 2024.

Meanwhile 60 percent of “Print Provider” specialists interested in purchasing new equipment in 2024 said they were doing so to expand into new markets—with CNC routers and flatbed printers their most popular choices.

“Other” sign shops listed Service Truck/Crane as their top choice, which makes sense since this category includes install-only shops. This was a top-three choice for “Full-Service” shops as well.

Top Equipment Planned to Purchase in 2024, according to shop revenue, were:

- Less Than $100,000: Digital Printer-Inkjet (an overwhelming 50% of this group)

- $100,000 to $499,999: CNC Router (50%)

- $500,000 to $999,999: Service Truck (56.3%)

- $1 Million and More: CNC Router (26.3%)

NOTE: Due to a calculating error, the December 2023 print version of this story featured incorrect choices error involving the number of respondents indicating plans to purchase in 2024, which will be addressed in the January 2023 edition. The editorial staff apologizes for this mistake and any confusion it may cause.

A popular reason cited for purchasing new equipment in 2024 is to keep more jobs in-house.

Respondent: “Bringing the heavier-duty routing and the smaller, finer cutting and engraving in-house would help us reduce some of our out-of-shop costs, as well as offer an expanded in-house offering.”

Respondent: “We currently outsource all our engraving and acrylic cutting. If I can get a laser that will handle ADA as well, I see that as my next big purchase.”

Respondent: “I want to purchase a DTF printer to further expand this segment of our business. We are currently subbing out having the print made to another wholesaler to apply in-house, and I want control over the whole process.”

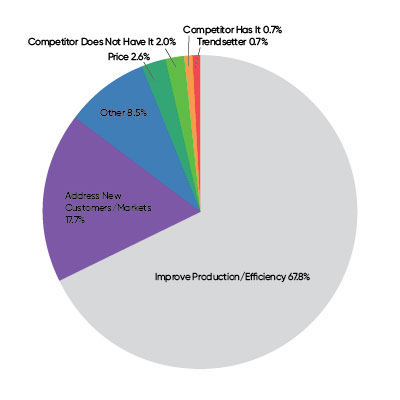

Q4: What would be your Number One reason for purchasing new equipment, even if you have no plans to do so in 2024?

Improving production workflow and efficiency is a big theme with many of our readers, as you’ll see with our next question.

Improving production workflow and efficiency is a big theme with many of our readers, as you’ll see with our next question.

For print providers, “Address New Customers/Markets” and “Improving Production Workflow” tied for their top two choices.

Meanwhile electric/dimensional shops chose “Improving Production Workflow” as their number-one selection.

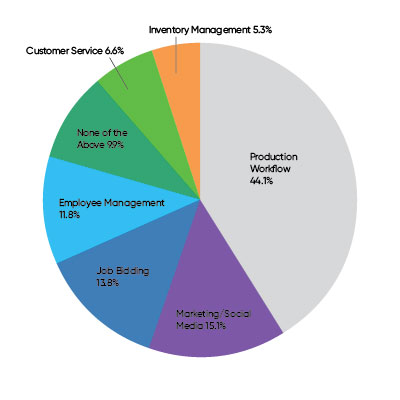

Q5: What would you most like to improve at your business in 2024?

Respondent: (Production Workflow) “We have a router table and we do graphics in-house; everything else comes from a wholesaler. I’m looking for a way to keep track of in-house jobs and what we have coming in. I recently purchased SquareCoil for this.”

Respondent: (Production Workflow) “We have a router table and we do graphics in-house; everything else comes from a wholesaler. I’m looking for a way to keep track of in-house jobs and what we have coming in. I recently purchased SquareCoil for this.”

Respondent: (Job Bidding) “We find that some sign shops bid so low on jobs that it makes our bid seem like we are gouging customers. The sign industry doesn’t have a consistent pricing outline. I quote a lot of national accounts; some tell me that I’m too cheap, and others tell me that I’m too high. It seems like, when work slows down, sign shops drop their prices, even if they’re losing money on the jobs.”

Q6: What is your outlook for the digital signage market in 2024?

Only 1.3 percent remarked that they had plans to decrease their work in this field. Those having no interest working in the digital signage field totaled 30.1 percent.

However a commanding 67.8 percent indicated that they did have plans to increase their work in this field in 2024.

Almost all participants identifying as “Electric/Dimensional” planned to increase their work; one lone hold-out expressed “no interest at all.”

We often hear about print and digital co-existing and complementing each other in the near future. This ended up being an exact 50/50 split amongst “Print Providers” in terms of having interest in 2024.